- Knowledge that we, parents, LOVE them; and,

- An understanding of what compound interest is.

I can see some eyebrows go up. What the heck is Marvin talking about here? compound interest? What has that got to do with kids and parenting?

I understand you.

There was one teacher in Plantation Elementary School (in Phillips, Bukidnon, home of Del Monte Philippines) whom I could not forget. I won't mention her name. She passionately taught us kids in Grade 4 what an interest rate was and what a "loan shark" was.

As she was talking, I remembered telling myself, oh this must be what Papa and Mama were talking about one Sunday morning. I heard words like "loan" and "interest." It didn't make any sense to me because my picture of "loan" was the "lawn" in front of our house where I and other kids played. Interest was simply a word you use when you liked something. This was 1978.

The drawback in this teacher's lesson was, it painted in my mind a picture of suffering and helplessness on the paying side of the equation. Then there were greedy and evil people on the other side of the equation. My young mind was therefore programmed into thinking that "interest rate" was not a pleasant subject to discuss.

Many years later, it was Robert Kiyosaki, through Rich Dad Poor Dad, Cashflow Quadrant and Rich Dad's Guide to Investing, who clarified my understanding. Robert basically said that "interest rate" could be pleasant or nasty, depending on what you made out of it. Then Robert proceeded to teach us how to make "interest rate" a pleasant thing.

So, how do we teach compound interest to our kids? Your guess may be as good as mine, but my wife and I stumbled into a strategy you might help us develop and adopt as your own.

Following Harv Eker's income allocation formula, we had a shelf loaded with six jars. One jar represented Financial Freedom Account, the second was Long Term Savings for Spending, while the third was Have Fun Now Account. Others were Education Account, Giving Account and Cost of Living Account. We were dropping coins in those jars to make automatic money allocation feel real. It was a habit forming program.

My son saw my wife putting coins in those jars. Later, he claimed one of the jars as his own. That partially wrecked our habit forming program, but we stumbled into something absolutely cool. My kinestetic son understood the physical act of saving, and he was seeing money grow inside the jar.

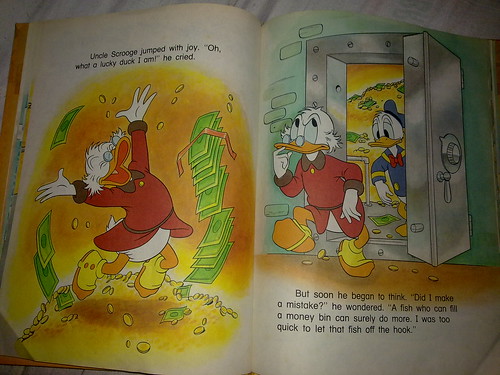

One night, my son and I had a talk. He told me he wanted to see all the jars filled. Then, once they get filled, we would get more jars and fill our house with money! He said, "Let's save our money, Daddy, just like Uncle Scrooge!"

I screamed inside me, Uncle Scrooge! I hated Uncle Scrooge when I was a kid. My son was of course referring to the Duck version of Uncle Scrooge from the Walt Disney story books.

What I saw was a fertile soil on my son's mind on which I could plant seeds of understanding compound interest. He understood that money could be saved. He understood that money could grow. In no time at all, it would be easy for me to tell him that there were jars that could actually make the coins grow on their own. I would then tell him that such jar was called compound interest jar.

I would then tell him to own several of these compound interest jars.

(Of course, I would also tell him about the other side of Uncle Scrooge, but that would be another story.)

![Fatherhood [dot] Win](http://4.bp.blogspot.com/-Zp0aJrEf_tA/Vzp_zbierhI/AAAAAAAALLo/m97Pks3DQmwmVpxM7Ckm_ZR9Q1f7uuu6wCK4B/s880/Blog%2BHeader%2BDesign%2Bv2.png)

No comments:

Post a Comment